Running a farm and growing crops is not easy. It takes many years of hard work as well as lots of hard-earned money to prepare crops for harvest. There is a whole list of things that can go wrong and ruin the yield for a farmer. Drought, heavy rain and flooding, strong wind and hail can all have a devastating effect on the harvest.

Because the weather has such a strong impact on their livelihoods, farmers are motivated to develop different strategies to manage weather risks. Agricultural risks are also the main cause of food insecurity, so improving conditions for smallholder farmers would reduce global poverty levels.

Connection Between Weather Risk and Index Insurance

Agricultural insurance is designed to protect farmers from events that are entirely out of their control, such as adverse weather and price drops.

From a weather risk management standpoint, there are two main types of risk to consider:

- Sudden events (like localized windstorms or hail)

- Long-term events that occur over a continuous period (like drought)

In order to successfully protect their crops from these types of events, farmers arrange crop insurance to get a compensation in case of crop damage.

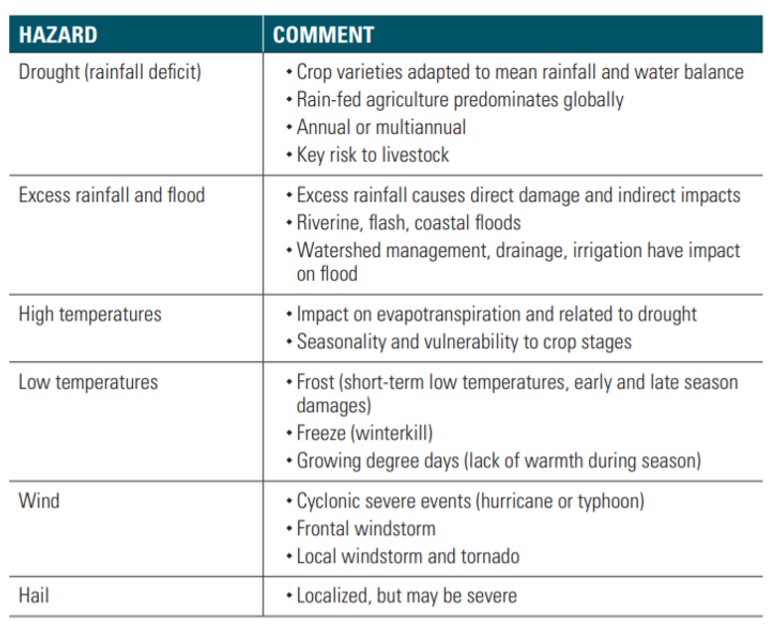

Main weather-related risks affecting agriculture

This type of risk mitigation tool can best be applied in an area where there is a strong connection between crop losses and adverse weather events.

Before managing weather risk, farmers have to assess it first. Risks are assessed by determining three key points:

- Hazard—type of risk (weather)

- Exposure—location of crops

- Vulnerability—an estimation of the impact the risk would have on the crops affected by it; varies according to the crop growth stage

In order to successfully protect their crops from bad weather events, farmers arrange a risk management strategy with an insurance company, called weather index-based insurance.

Weather risk mapping is a practice that enables risk identification, assessment, and management. It can be assessed through a combination of the following parameters:

- Weather risks (wind, temperature, rainfall, hail); called an index

- Type of crops subject to those risks (oilseed crops, vegetables, trees, etc.)

- Number and type of producers that grow those crops

- Location of weather stations; form a secure network that is different from country to country

- Agro-climatic zones; gathered from satellite imagery (gives information about how different factors and attributes relate over space and time)

- Altitude

Weather index insurance relies on historical and current weather data. Current data is measured by local weather stations and they record at least 20 years of historical data, which is used when insurance companies are trying to assess weather risk.

An Effective Risk Management Tool for Farmers

With all of the above said, we can say with certainty that weather indexing is a broad area, and it is a crucial element in defining what type of insurance farmers want to use. It also plays a big role in calculating the cost of the premium.

Besides risk management in the form of crop insurance, farmers can apply other risk mitigation measures to minimize yield losses. For example, if they know that their farm is located in a high-risk area of drought, they can start using crops to increase resilience (e.g. appropriate crops, varieties and cropping patterns; irrigation) and take proper adaptation measures in order to avoid risks.

Also, if a certain crop is susceptible to extreme weather conditions and diseases, farmers should redirect their production to a more sustainable crop that will bring more profit in the long run.

Insurance companies use a strategy defined for a certain type of risk (in this case weather) called weather index-based insurance and offer it to farmers as a risk mitigation tool. If you are an insurance company and you wish to learn how you can greatly prevent inaccurate assessments and wrongful damage compensation, please contact AGRIVI Sales team.

Text sources: FARMD || IFAD

Image sources: FARMD